In 1929, Joseph Kennedy Sr (JFK’s dad) was working as a Wall Street stockbroker when he decided to get out of the market and take short positions after overhearing a shoeshine boy giving stock tips. Subsequently, the stock market crashed, leading to Black Monday and Black Tuesday, and Kennedy profited immensely, earning an estimated $150 million, equivalent to $3.5 billion today. He spotted a bubble when everyone was talking about it. I think the bubble today exists around 321. When I first wrote about the 321 exemption in 2019 it was a little known trick known only to logistics nerds. Today it’s a common term frequently used by marketers and TikTok influencers.

Why is 321 important?

Under Section 321 of the U.S. Customs regulations, individuals have been able to receive one package per day valued under $800 without paying duties on it. Originally intended as a benefit for private individuals bringing items home from vacation or sending gifts, this exemption has been exploited by clever e-commerce companies, resulting in several hundred billion dollars in lost revenue to the government annually.

The 321 parcel exemption has effectively allowed companies to source goods from China without paying the associated tariffs, creating an entire ecosystem of fulfillment warehouses along the northern and southern borders that cater specifically to 321 shipments. This loophole has been leveraged by players as diverse as True Classic and Temu which has allowed them to bypass tariffs and therefore enjoy a major cost advantage with products imported and then sold domestically.

Why I think it will be closed

There’s a lot of money at stake

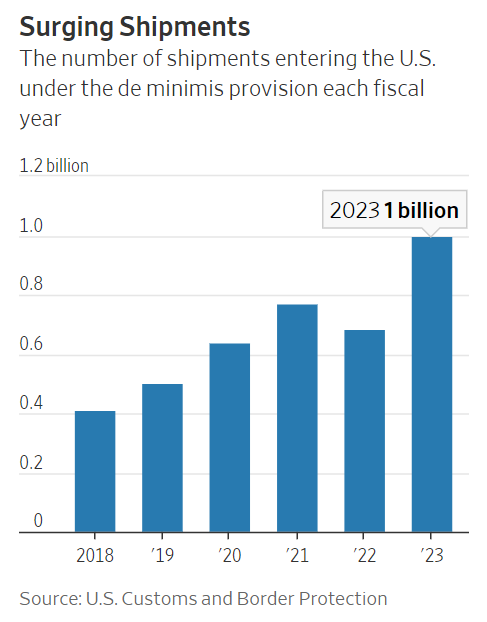

According to estimates by the Wall Street Journal, the cost to the US was already staggering at $188 billion per year in 2022 which had grown from $67B in 2021. Today the number of shipments taking advantage of this loophole are estimated at around 1B in 2023 meaning that the loss in government revenue is probably close to $300B.

Geopolitics

The 321 parcel exemption has become synonymous with China, amplifying political pressure to take action. A June 2023 report from the House of Representatives revealed that over 30% of all daily packages shipped to the US originate from Chinese e-commerce platforms such as Shein and Temu. This reliance on Chinese imports has raised concerns about job loss in domestic manufacturing and warehousing sectors, further fueling calls for the closure of the loophole.

Global Norms

From a global perspective, the US de minimis exemption stands out as one of the highest in the world, creating an imbalance in trade practices. For comparison, the UK is 150 GBP ($191 USD), Canada’s de minimis exemption is around 20 CAD ($12 USD), and China has $0 de minimis meaning all shipments owe duties. Check here for a full list of de minimis values.

Technological Viability

Advancements in technology have made it feasible to track and monitor imports more effectively. With the implementation of systems like ACE in customs, requiring importers to file declarations for all incoming packages becomes a viable solution to address the loophole fairly easily.

What will happen when it closes?

I recently sat down with Chris Wall of Zeus Logics and learned quite a bit about the potential ramifications of this impending regulatory shift.

Customs authorities have hinted at the closure of the 321 loophole, signaling a shift towards tighter regulations on duty-free imports. While the exact timeline remains uncertain, it is anticipated that a formal announcement will precede a phased implementation process, providing affected parties with time to adapt to the new regulatory environment.

One of the most notable consequences of the closure will be the reconfiguration of global manufacturing dynamics. The competitive advantage enjoyed by certain products, companies, or categories—particularly those reliant on low-cost manufacturing—will evaporate. E-commerce giants like Temu and Shein may find their pricing strategies less effective, leveling the playing field for competitors.

The closure of the 321 exemption is also poised to reshape the global airfreight industry. Currently, some airlines charter a significant number of planes daily to support the influx of packages from platforms like Temu and Shein.

The closure of the exemption is likely to have far-reaching implications for China’s low-cost factory ecosystem. As companies reassess their sourcing strategies and seek alternatives to mitigate the impact of tariffs, the demand for Chinese manufacturing may decrease, potentially disrupting established supply chains and economic dynamics in the region.

What should you do?

In the short term, maintaining the status quo may be the most prudent course of action. If your business currently benefits from the 321 exemption, there is no need to alter your strategy- you won’t get bonus points for incurring more cost today.

However, it is crucial to have an exit plan in place for when the closure eventually takes effect. Conduct a thorough analysis of your business model and assess the potential impact of tariffs on your operations. Evaluate whether your current pricing strategies and profit margins remain viable in a post-321 landscape.

Simultaneously, explore alternative manufacturing and sourcing options outside of China. Diversifying your supply chain and exploring production facilities in other countries can help mitigate the impact of tariffs and reduce dependence on a single market. Consider countries with favorable trade agreements, competitive labor costs, and robust infrastructure to ensure the resilience of your supply chain. This is something that companies like Sourcify can help with.

Ultimately, proactive preparation and strategic foresight will be key to weathering the challenges posed by the closure of the 321 parcel exemption. When it happens it will be messy and chaotic for a time, but by staying informed, assessing your options, and implementing contingency plans, startups can position themselves for success in the evolving global trade landscape.